Flexibility at its Best: The Rise of Flexible Workspaces

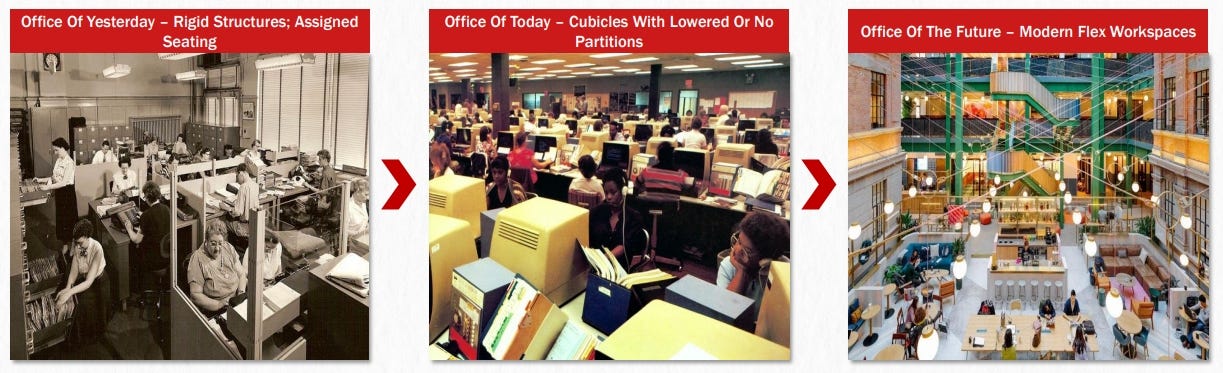

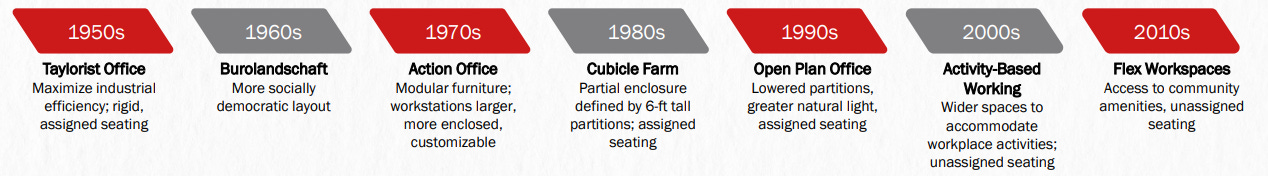

Picture this: It's the late 1990s, and office spaces are mostly towering, gray buildings with floors filled with cubicles. Workers squeeze into these assigned little squares every day, barely moving from one to another. The environment is rigid, and everything—from desk placement to wall color—echoes a structure designed for permanence. This office model, while efficient in its day, couldn’t have predicted the changes to come.

Now, fast forward to today. The "office" as we once knew it has transformed beyond recognition. Driven by the need for greater flexibility, efficiency, and employee well-being, what began as a gradual shift has become a global movement. Companies like Google, Amazon, and countless startups have embraced flex workspaces, reflecting a vibrant, tech-driven culture. This transformation was not overnight—it was the result of decades of evolution, influenced by economic upheavals, technological advancements, and, most recently, a global pandemic.

Today, envision a workspace where the boundaries between work and play dissolve, where collaboration is as abundant as the coffee, and where a thriving community buzzes with productivity. This is the core of coworking spaces, a groundbreaking concept that's redefining the future of work.

Yet, coworking is more than just a stylish alternative to traditional offices. It’s an intricate and evolving ecosystem with its own unique set of nuances, challenges, and opportunities. In this deep dive, we'll explore the multifaceted world of coworking, dissecting its diverse landscape, examining its business models, and peering into its future. Join us as we explore the rise of coworking spaces, delve into their diverse landscape, and uncover the forces shaping the future of work.

What Exactly is a Coworking Space?

Coworking spaces, also known as flexible workspaces or shared offices, offer a refreshing alternative to traditional office environments. They provide fully furnished and serviced workspaces, often with flexible lease terms, customized designs, and a variety of amenities. These spaces cater to a diverse clientele, from freelancers and startups to large enterprises and multinational corporations (MNCs).

What Sets Coworking Spaces Apart?

Flexibility and Freedom: Forget rigid long-term leases. Coworking spaces offer flexible memberships, allowing you to scale your workspace as your business grows. Need a dedicated desk? A private office? Or just a day pass? The choice is yours.

Community and Collaboration: Coworking spaces are more than just places to work; they are communities of like-minded individuals. Imagine networking events, workshops, and social gatherings that connect you with potential collaborators, mentors, and friends.

Cost-effectiveness: Coworking spaces often translate to lower fixed costs, as companies pay for the space they use, potentially reducing overhead expenses.

Enhanced Productivity: A well-designed coworking space with a variety of work settings, including open work areas, private offices, and collaborative zones, can boost creativity and productivity.

The Evolution of Flex Workspaces: From Executive Suites to Hybrid Offices

1. Early Beginnings: Business Centers and Executive Suites (1980s-1990s)

In the 1980s, business centers and executive suites were the original flex workspaces. These facilities offered short-term rental spaces to companies that couldn’t commit to long leases, such as small businesses, project teams, and traveling executives. These spaces provided essential office facilities, secretarial services, and on-demand meeting rooms—a truly novel idea at the time.

Though not yet a mainstream concept, these early business centers laid the foundation for what would eventually become a billion-dollar industry. But even as companies like Regus (now IWG) pioneered these flexible offices, the sector remained niche, lacking the innovation and community focus that would later redefine it.

2. Dot-Com Boom and the Rise of the Startup Culture (Late 1990s - Early 2000s)

With the dot-com boom, the need for flexible workspaces became urgent. Suddenly, tech startups were popping up everywhere, fueled by venture capital and big dreams but constrained by limited cash flow. These companies needed temporary spaces with lower financial commitments to support their rapidly fluctuating teams.

This was when Regus (now IWG), one of the first major players in flexible workspaces, started to gain traction. Regus provided "office-as-a-service" to companies that needed flexibility, creating spaces where businesses could operate without locking into long-term commitments. For the first time, larger corporations and startups alike could access high-quality office space in prime locations without the burdens of ownership or fixed leases. This period marked the initial transformation of the flex workspace from a niche offering into a budding industry.

But the concept of co-working as a community-driven space was still on the horizon. Regus was a pioneer, but its model still leaned on tradition—just with shorter leases and shared amenities.

3. The Co-Working Revolution (Mid-2000s to 2015)

The real breakthrough for flexible workspaces came with the rise of co-working culture in the 2000s. In 2010, WeWork entered the scene and redefined the concept of an office. In 2010, Adam Neumann and Miguel McKelvey took the idea of flexible spaces and layered it with a community-centric approach. Co-working wasn’t just about desks and Wi-Fi anymore—it became about building an environment that encouraged collaboration, creativity, and connection. At WeWork, people weren’t just renting desks; they were joining a culture.

This shift attracted freelancers, small teams, and startups that wanted more than just space—they wanted community and networking. Co-working spaces became hubs of innovation where entrepreneurs could meet investors, hire talent, and exchange ideas. In cities like New York, London, and San Francisco, co-working spaces transformed entire neighborhoods into thriving, entrepreneurial ecosystems.

By 2015, The “co-working revolution” reshaped the idea of workspaces into collaborative environments where networking and social interaction were core offerings. This period also saw a flood of new players—Spaces, Industrious, and others—each adding their flavor to the co-working model. For the first time, the office wasn’t just a physical space but an experience, and that experience became a selling point.

4. A New Office Mindset: The Asset-Light Model and Enterprise Adoption (2015-2020)

By 2015, the demand for flexibility had grown beyond just startups. Large enterprises started experimenting with co-working spaces as well. Multinational corporations like IBM and Microsoft saw the benefits of flexible leases and co-working environments that allowed them to expand or shrink office space based on needs.

This shift also brought the “asset-light” model to the forefront. Instead of owning real estate, companies could “rent” their workspaces from operators who managed everything—from furniture and Wi-Fi to cleaning and reception. For enterprises, this reduced capital expenditure, freed up cash flow, and allowed teams to focus on core business.

Companies like IWG and Knotel adapted to serve these large clients, offering a blend of private managed spaces and co-working amenities. The flex workspace model now offered everything from single desks to entire floors, each customized to meet the specific demands of corporate clients. The office had become a service—one that could be scaled, customized, and tailored.

5. COVID-19: The Catalyst for Flex Workspaces (2020-2021)

In 2020, COVID-19 triggered a massive shakeup across the world, with most of the global workforce suddenly forced to work from home. The pandemic altered the entire office landscape practically overnight. Many companies went remote, cancelled leases, and began questioning the necessity of large, central headquarters. For the first time, working from anywhere became the standard rather than an exception.

For flex workspaces, this disruption was both a challenge and an opportunity. Initially, co-working spaces were hit hard, as lockdowns made shared spaces less appealing. Some operators struggled with maintaining occupancy, while others adapted by quickly introducing safety protocols, touchless technology, and staggered desk arrangements to accommodate social distancing. This adaptability became a hallmark of the flex workspace sector.

Yet, as companies faced mounting uncertainty, flex spaces emerged as the most viable option for the future. The pandemic underscored the need for office spaces that could easily scale up or down based on immediate business needs. This, combined with employees’ growing preference for hybrid work, positioned the flex workspace sector for unprecedented growth.

6. Post-COVID: The Rise of the Hybrid Office and the Future of Flex Workspaces (2022 and Beyond)

Post-pandemic, the office is no longer just a place to go every day. It’s now a dynamic, flexible tool for collaboration, culture-building, and occasional team gatherings. Flex workspaces are perfectly positioned to meet this new demand, as companies worldwide adopt hybrid models that blend remote work with office-based collaboration.

Here’s what the post-COVID flex workspace model looks like:

Hybrid and Satellite Offices: Companies are now decentralizing their offices, setting up smaller, regional hubs where employees can drop in as needed. This “hub-and-spoke” model gives employees access to an office closer to home without the need for a single, large headquarters.

Managed Offices and Enterprise Suites: Many companies have moved to managed offices that provide a branded, private workspace within a flexible office setting. These spaces come with state-of-the-art amenities, security, and the ability to scale, combining the benefits of traditional offices with the agility of co-working.

Tech-Integrated, Wellness-Focused Spaces: Flex workspaces today are equipped with IoT devices, booking apps, and virtual collaboration tools to support hybrid work. They’re also increasingly focused on wellness, with features like air purification, natural lighting, and ergonomic design to cater to the needs of a health-conscious workforce.

Post-COVID, flex spaces are not just alternatives to traditional offices; they are the new norm. Companies like Google, Meta, and countless others have reimagined their real estate strategies, leaning on flex spaces for scalability and flexibility in a world where uncertainty is the only constant.

Market Size and Growth

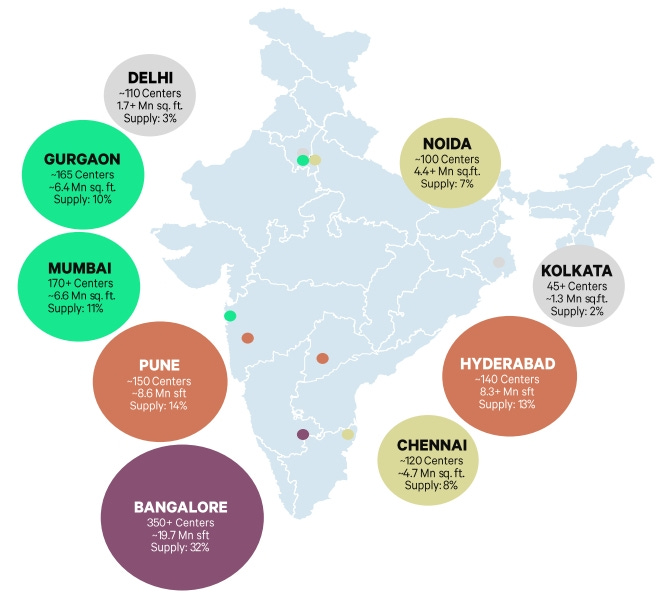

The flexible workspace market in India has experienced significant growth, with the total stock reaching approximately 67.5 million sq. ft. as of December 31, 2023. In Tier 1 cities, the total stock has surged from over 20 million sq. ft. before 2019 to approximately 62 million sq. ft. in 2023, driven by the dynamic needs of businesses and the rise of tech-enabled work cultures. Similarly, Tier 2 cities have seen the total stock expand from about 1.7 million sq. ft. in 2019 to around 5.7 million sq. ft. in 2023, indicating a growing demand for flexible workspaces beyond the primary urban centers.

Looking ahead, the market in Tier 1 cities is expected to continue its upward trajectory, growing at a CAGR of 16% through 2026 to reach approximately 96.2 million sq. ft. Tier 2 cities are also set to grow at a CAGR of 16%, with the stock projected to reach approximately 8.5 - 9 million sq. ft. by 2026. Overall, the total addressable market (TAM) for flexible workspaces in India is expected to be approximately 105 million sq. ft. by 2026. As of H1 2024, the flexible workspace footprint across the top 8 cities reached 58 million sq. ft., with Bangalore leading at 31% of the total stock. India's office space demand is set to exceed 70 million sq. ft. in 2024, driven by IT-BPM, flexible workspaces, and BFSI sectors. The flexible workspace market in India is expected to reach 126 million sq. ft. by 2027, with a CAGR of 22%.

City wise share of supply & absorption in Q3 2024

Penetration Rate and Demand

The penetration rate of flexible workspaces in India has seen a notable increase, from 9% in 2020 to 13% by the end of 2023, reflecting the shifting preferences of companies towards more agile and cost-effective workspace solutions post-COVID-19. This rate is expected to further rise to approximately 15.5% by 2026, signifying the growing acceptance and integration of flexible workspaces into the mainstream office market.

Demand for flexible workspace seats is anticipated to grow at a CAGR of 18-19% between 2022 and 2026, driven by the need for versatile working environments that support hybrid work models. Tier 2 cities, in particular, are expected to witness strong demand in line with the growth in supply, as businesses increasingly recognize the benefits of establishing operations in these regions.

Currently, India hosts over 430 flexible workspace operators, with the top 10 operators accounting for nearly 60% of the overall pan-India flex stock. Prominent names in the industry include Awfis, WeWork, Smart Woks, Tablespace, and Indiqube, all of which play a significant role in shaping the landscape of flexible workspaces across the country.

Growth Drivers: Why Flex Workspaces Are Booming

a. The Rise of Hybrid Work

The COVID-19 pandemic made hybrid work a reality overnight. As companies adapted to remote work, employees experienced the flexibility and convenience of working from anywhere. Now, even as offices reopen, employees and employers alike are reluctant to go back to the old 9-to-5 grind.

Hybrid work has led to a demand for spaces that support both in-office and remote work. Flex spaces allow companies to maintain smaller footprints, renting only what they need for collaboration days and team events. This shift is evident in the growth of satellite offices and regional hubs that provide a place for employees to drop in as needed, rather than commuting to a central office.

Think of the flex workspace as a utility rather than a fixed asset. Just as people turn on and off lights as needed, companies can adjust their office space requirements dynamically, which perfectly suits the new hybrid reality.

b. Cost Efficiency and Operational Flexibility

The traditional office model is capital-intensive and rigid, requiring long leases and significant upfront investment. For companies facing uncertain economic conditions, flex workspaces offer a breath of fresh air. Instead of committing to long-term leases, businesses can pay only for the space and amenities they need, scaling up or down in response to market conditions.

For smaller firms and startups, the cost efficiency is especially appealing. Many flex operators offer tiered memberships or on-demand access, allowing companies to reduce operational costs significantly. This asset-light model helps firms focus capital on growth, rather than tying it up in real estate.

c. The Rise of the Startup Ecosystem

Startups have been one of the most significant growth drivers in the flex workspace sector. Young companies often lack the resources or long-term vision required for traditional office leases. Flex spaces provide them with fully-equipped offices that are ready to use and can grow as the team expands. They also offer networking and collaboration opportunities that are often essential for early-stage ventures.

In regions like India, where the startup ecosystem is booming, flex workspaces serve as incubators, attracting ambitious entrepreneurs who can scale their space as their teams grow. In return, these spaces benefit from the dynamism and innovation of the startup community.

d. Employee Well-Being and Workspace Experience

The modern workforce values well-being, work-life balance, and autonomy over strict office hours. Many employees want a workspace that doesn’t just give them a desk but also a community, amenities, and options for collaborative work. Flex spaces have responded by creating dynamic environments complete with wellness features—think meditation rooms, ergonomic workstations, and fitness areas.

For example, operators like WeWork and Spaces are integrating wellness into the very DNA of their spaces, with airy designs, natural lighting, and community events that foster social engagement. This shift toward creating not just a workspace, but an experience, has been a significant factor in the success of flex workspaces.

e. Technology-Enabled Flexibility

Technology is the backbone of flex workspaces, from IoT-enabled meeting rooms to seamless digital booking systems. As businesses adapt to hybrid work, they rely on tech integrations for video conferencing, virtual collaboration tools, and booking apps that allow employees to reserve desks or rooms as needed.

Flex spaces equipped with these technologies can offer a truly seamless experience for companies with distributed workforces, allowing employees to connect effortlessly, even across different locations. With companies increasingly adopting remote-friendly solutions, tech-enabled flex spaces are well-positioned to lead the office revolution.

The Challenges Ahead: What Could Slow Down the Flex Workspace Boom?

a. Economic Volatility and Market Uncertainty

While flex workspaces offer solutions for cost savings, they are not immune to economic downturns. During recessions or periods of market uncertainty, businesses often reduce expenses, which can impact occupancy rates in flex spaces. Although flex workspaces provide a more cost-effective solution than traditional leases, operators still depend heavily on consistent occupancy to maintain profitability.

For instance, the 2020 pandemic downturn forced many operators to adopt creative leasing structures, reduce prices, and implement aggressive safety protocols just to keep occupancy stable. Any future downturns could pressure the flex space sector to adapt again, often at the expense of their margins.

b. High Competition and Oversupply

As demand for flex spaces grows, so does the number of operators. Major players like WeWork, IWG, and Knotel are expanding aggressively, but so are numerous local and niche providers, leading to a highly competitive environment. In markets like New York and London, oversupply can already be seen, leading some operators to cut prices to maintain occupancy.

With more players crowding into the sector, many operators face the risk of falling revenues and increased vacancy rates, especially in prime markets. Differentiation and maintaining premium service quality will be key for operators to avoid a race to the bottom in pricing, which could threaten the financial health of the sector.

c. Occupancy-Dependent Revenue Model

The success of flex workspaces hinges on maintaining high occupancy rates. Fixed costs—like leases, maintenance, and utilities—don’t fluctuate with occupancy, meaning any drop in client numbers has an immediate impact on profitability. This reliance on occupancy can be particularly risky in the event of economic downturns, shifts in work culture, or even seasonal demand fluctuations.

For example, the sudden shift to remote work during COVID-19 saw some operators grappling to fill desks, leading to a reassessment of revenue-sharing models and even strategic partnerships to spread risk. If flex workspaces are to succeed long-term, operators need to develop more diversified revenue streams and pricing models that mitigate reliance on occupancy.

d. Balancing Flexibility with Profitability

Flexibility is the core offering of the flex workspace model, but it’s a double-edged sword. Offering short-term leases and month-to-month memberships can attract clients, but it can also lead to revenue volatility. Unlike traditional offices, which rely on stable, long-term leases, flex workspaces face the challenge of balancing flexibility with consistent cash flow.

Operators have started adopting revenue-sharing agreements with landlords and hybrid lease structures to manage this, but finding the right balance remains challenging. Overly flexible agreements can result in lower profit margins, while rigid terms may turn away clients looking for genuine flexibility.

e. Real Estate Market Sensitivity

The flex workspace model depends on leasing or managing commercial real estate—often in prime locations. This reliance on real estate makes operators vulnerable to shifts in property values and leasing costs. In high-demand cities like New York and London, escalating rents can pressure operators to raise prices, which may reduce their competitive edge.

Furthermore, the model’s reliance on leasing means operators have limited control over their assets, making them susceptible to rent hikes. Some companies have experimented with owning their buildings, but this requires significant capital and goes against the asset-light approach that has fueled flex workspace growth.

f. Demand-Side Churn

Demand-side churn, or client turnover, in flex workspaces refers to the rate at which clients leave over a specific period, usually expressed as a percentage of total clients. Factors influencing churn include competition, client satisfaction, pricing, and the quality of amenities. Causes of high demand-side churn are short-term contracts, intense market competition, client growth or downsizing, and poor service quality. This churn can lead to revenue instability, increased client acquisition costs, and reduced community cohesion, impacting the overall value proposition of flex workspaces. Managing churn effectively is crucial for maintaining stable revenue and a strong community environment.

g. Supply-Side Churn

Supply-side churn refers to the turnover rate of properties that a flex workspace operator leases and manages, reflecting how frequently operators exit leases or locations due to profitability issues, market saturation, or demand shifts. High supply-side churn can disrupt an operator’s portfolio and impact financial stability. Causes include unprofitable locations, market oversupply, economic downturns, and lease expiry decisions. The impact of supply-side churn includes financial losses, damage to brand reputation, and operational instability. Exiting unprofitable locations, managing market oversupply, and making strategic lease renewal decisions are crucial to mitigating these risks.

Major issue — Navigating the Competitive Landscape in Flex Workspaces

The Players: Who’s Competing in Flex Workspaces?

The flex workspace market is filled with diverse players, each targeting specific segments of the market:

Global Giants: Companies like WeWork, IWG (Regus), and Spaces have established themselves as major international brands, leveraging scale, recognizable branding, and premium locations to attract multinational corporations and high-end clients.

Regional Leaders: In markets like India, Southeast Asia, and Europe, companies like Awfis, Knotel, and Industrious have built strong regional presences, often with custom offerings tailored to local demand. They focus on understanding specific market needs, which can be a competitive advantage over larger, global players.

Niche and Specialized Providers: Some operators target niche markets, such as tech startups, creatives, or wellness-focused spaces. These players create highly customized environments designed to meet the specific needs of certain industries, often building loyal customer bases through this targeted approach.

New Entrants and Startups: Startups and smaller entrants regularly join the flex workspace industry, offering unique value propositions such as tech-enabled spaces, affordable rates, or smaller footprint locations. Their agility allows them to innovate quickly, but sustaining growth can be challenging in a crowded market.

With such a varied competitive field, the pressure to innovate and stand out has never been greater. Each player is not only competing on price but also on experience, amenities, and location. let’s see how players can position themselves better,

How to Compete and Thrive: Strategies for Success

To survive and succeed in the competitive flex workspace landscape, companies need a clear strategy and unique offerings. Here are some key strategies that can help flex workspace operators stay competitive and grow:

a. Focus on Customer-Centric Customization

Understanding the specific needs of clients and creating customized solutions can set a flex workspace operator apart. For example, enterprise clients may want dedicated spaces with their branding, enhanced security, or exclusive meeting rooms. Customizing spaces to align with the unique requirements of various client segments (startups, large corporations, freelancers) can foster loyalty and increase retention.

b. Leverage Technology to Enhance Client Experience

Operators should invest in technology that supports the needs of hybrid and remote teams, such as advanced booking systems, remote access, and smart room configurations. For instance, a mobile app that allows clients to book meeting rooms, check in virtually, and access amenities makes the experience seamless. Integrating IoT devices can also enhance the workspace, allowing for personalized lighting, climate control, and access control.

c. Build Strong Community and Networking Opportunities

Creating a vibrant community through networking events, mentorship programs, and professional development workshops can be a powerful differentiator. A strong community fosters client engagement, loyalty, and satisfaction, making them more likely to renew leases or recommend the space to others. Community-building efforts can make a workspace feel like more than just an office, creating a unique value that clients can’t find elsewhere.

d. Innovate with Flexible Membership and Pricing Models

Flexibility is the core offering of the sector, so operators should experiment with varied membership structures to meet diverse client needs. This might include offering hourly, daily, and weekly options, discounted corporate packages, or even subscription models for hot-desking. Providing flexibility in pricing can attract a wide range of clients—from freelancers looking for occasional desks to enterprises needing dedicated office space.

e. Prioritize Sustainability and Well-Being

Increasingly, clients expect workspaces to be environmentally friendly and support wellness. Operators can invest in green infrastructure, energy-efficient design, and wellness-focused amenities like air purification systems, fitness facilities, and quiet zones. Promoting these features can attract eco-conscious clients and differentiate the brand as a wellness-oriented, sustainable workspace provider.

f. Optimize Location and Space Utilization

Selecting strategic locations is essential, especially as companies adopt a hub-and-spoke model with smaller, distributed offices closer to employees’ homes. Operators should consider satellite offices in suburban locations or expand into Tier 2 cities, where competition may be less intense, but demand is rising. Additionally, maximizing space utilization within a location—such as reconfiguring spaces based on demand—can increase revenue without expanding physical space.

g. Create Strategic Partnerships with Landlords and Vendors

Working closely with landlords to negotiate flexible lease terms or revenue-sharing agreements can reduce operators’ fixed costs and mitigate occupancy risk. Likewise, partnerships with vendors can improve service quality while reducing operational costs. For instance, collaborating with tech companies to bring smart solutions to the workspace or teaming up with wellness providers for on-site fitness services can enhance the client experience.

The Flex Workspace Value Chain: Key Players and Their Roles

At the core of the flex workspace model are several interconnected players, each contributing uniquely to the ecosystem:

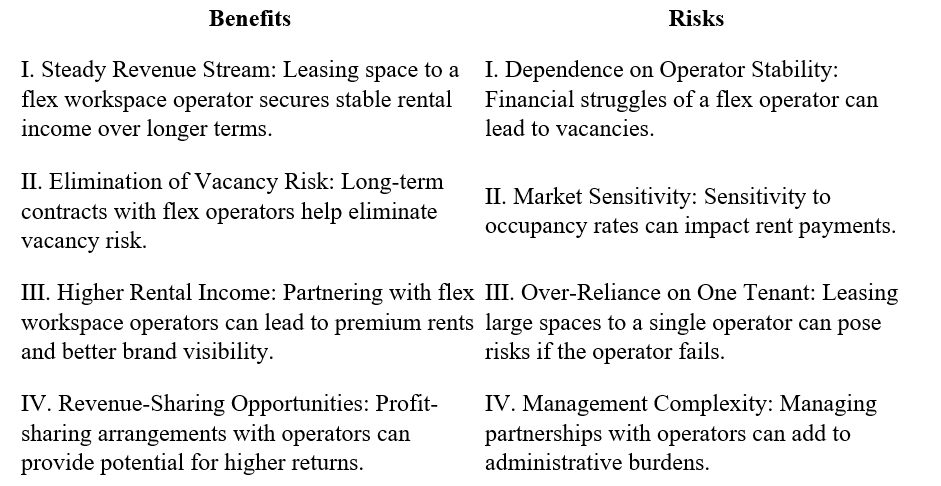

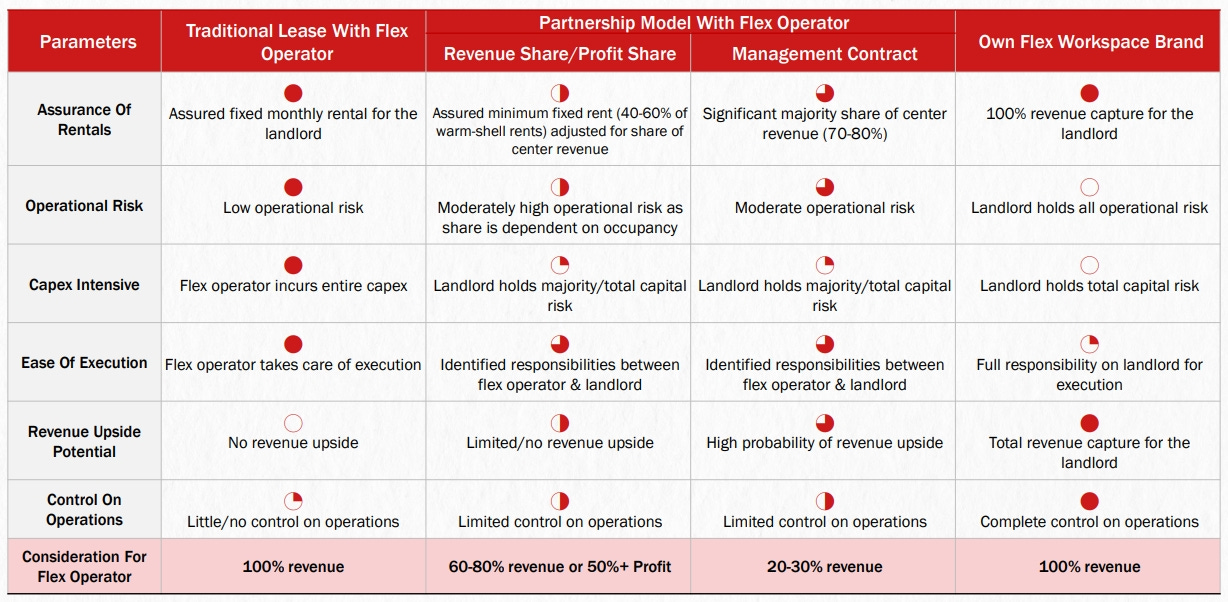

Landlords: These are the property owners who lease commercial spaces to flex workspace operators. This category includes developers, high-net-worth individuals (HNIs), and real estate investment trusts (REITs).

Operators: Companies like WeWork, Regus, Awfis, and Spaces lease, manage, and transform office spaces into flexible workspaces. They curate environments that cater to various client needs.

Service Providers: These vendors supply essential services such as security, maintenance, IT, and cleaning. They also include fit-out providers for furniture, fixtures, and interior design. Some operators offer these services in-house, while others collaborate with external providers.

Tenants: The end users who rent space in flex workspaces. They range from freelancers and startups to SMEs and large corporations. Tenants can choose from individual desks, private offices, or custom suites.

Each player in this chain has distinct responsibilities, value additions, benefits, and risks. Below, we delve into these aspects for each segment.

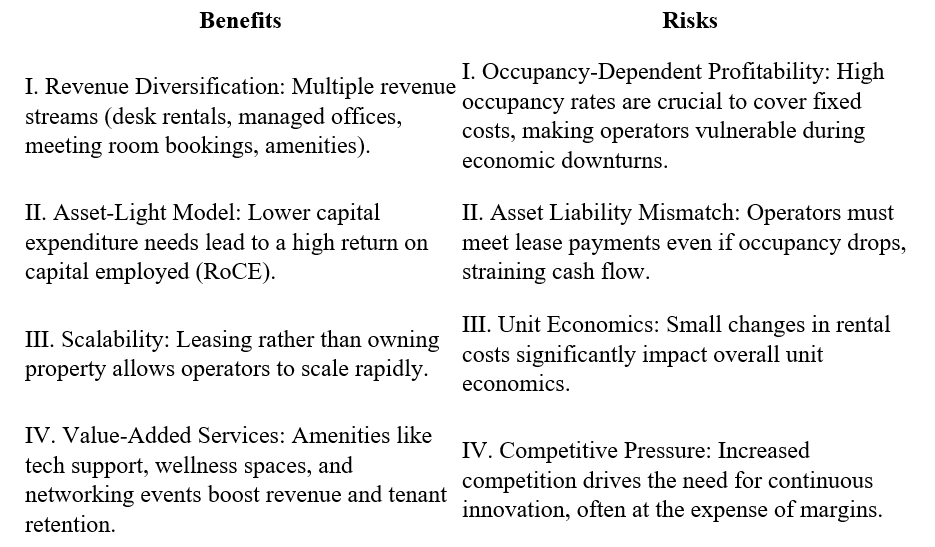

Benefits and Risks Across the Flex Workspace Value Chain

a. Landlords: The Property Providers

b. Operators: The Flex Space Curators

c. Tenants: The End Users

Different business/Operating models

1. Traditional Co-Working Model: The Community Hub

How It Works:

The co-working model is one of the earliest and most popular business structures in flex workspaces. It revolves around the idea of creating open, collaborative environments where individuals and small teams can work alongside each other. Co-working spaces typically offer hot desks, dedicated desks, meeting rooms, and basic amenities such as high-speed internet, coffee, and shared kitchen areas.

Target Clients:

Freelancers, remote workers, startups, and small businesses that benefit from community interaction and flexible, affordable workspaces.

Revenue Streams:

Revenue primarily comes from membership fees, which can be structured as daily, weekly, or monthly passes. Some spaces also generate additional income from hosting events, providing on-demand meeting rooms, and offering premium memberships that grant extra amenities or access to exclusive areas.

Benefits and Challenges:

The co-working model is attractive because of its simplicity and wide appeal, but it can be challenging to maintain profitability. Operators rely on high occupancy rates to cover costs and keep fees competitive. Community building and networking events are also essential to create a sense of belonging, which helps with retention but requires continuous investment.

Occupancy Considerations:

Ideal Rate: 75-85%.

Strategies: Flexible memberships, community events, and flexible seating.

2. Managed Office Model: The White-Glove Experience

How It Works:

The managed office model provides larger, private spaces that are fully serviced, customizable, and often branded to meet a client’s specific needs. Managed office operators take care of everything from setup to daily operations, allowing companies to have their own dedicated space without managing a traditional office lease.

Target Clients:

Mid-size and large enterprises, including multinational corporations, that need flexibility but want private spaces that reflect their corporate identity.

Revenue Streams:

Managed offices generate revenue through fixed monthly fees for long-term agreements, often with a premium for customization and add-on services. Some operators also charge additional fees for branding, exclusive amenities, and upgrades in design, other Value-added services.

Benefits and Challenges:

The managed office model is attractive for its high revenue potential, especially from corporate clients willing to pay for customization and convenience. However, operators face high setup costs and longer-term lease obligations with landlords. This model also demands a strong understanding of each client’s brand and operational needs to deliver a tailored experience.

Occupancy Considerations:

Ideal Rate: 80-90%.

Strategies: Tailored spaces, corporate networking, and partnerships.

3. Sharing Model: Sharing the Ups and Downs

How It Works:

In the sharing model, the operator and the landlord share profits based on the revenue generated from the space. Instead of paying a fixed rent, the operator pays a percentage of their monthly earnings to the landlord. This setup aligns the interests of the landlord and operator, as both parties benefit from high occupancy rates and premium pricing. The MA model is ideal for operators looking to expand into new markets or locations with uncertain demand. It’s also a good fit for emerging or suburban markets where operators want to limit financial risk and capital investment. As fit-out cost is fully born by the landlord as per the customized contract.

Target Clients:

Startups, small businesses, and freelancers who need affordable, flexible space options. This model also attracts landlords who are willing to take on some operational risk in exchange for higher potential returns.

Revenue Streams:

Revenue-sharing agreements offer operators flexibility, as they avoid the burden of fixed rent costs. Income varies based on occupancy, client demand, and the specific terms of the profit-sharing arrangement.

Benefits and Challenges:

This model is advantageous for operators in unpredictable markets, as it reduces risk when occupancy fluctuates. It’s also appealing for landlords who want to tap into the flex workspace market without directly managing it. However, revenue sharing can create challenges if demand is inconsistent, as both operators and landlords may face reduced income during slow periods.

Occupancy Considerations:

Ideal Rate: Above 85%.

Strategies: Revenue-linked incentives, dynamic pricing.

4. Hybrid Model: The Best of Both Worlds

How It Works:

The hybrid model combines elements of co-working, private offices, and managed spaces. A hybrid flex workspace may offer open desks for freelancers, private offices for small teams, and managed suites for larger companies—all under one roof. This diversity allows operators to serve a wide range of clients with varied needs.

Target Clients:

Startups, small businesses, corporate teams, and even individual freelancers. The hybrid model attracts companies looking for flexible, scalable solutions in a single space.

Revenue Streams:

The hybrid model offers multiple revenue streams, from daily desk rentals and monthly memberships to long-term office leases and customized managed suites. Operators can increase revenue by offering premium services and creating separate tiers of membership.

Benefits and Challenges:

The hybrid model maximizes revenue potential by appealing to a broad client base, allowing operators to spread risk across various segments. However, managing such a diverse range of clients and offerings can be complex, requiring a strong operational team and robust technology infrastructure.

Occupancy Considerations:

Ideal Rate: 80-90%.

Strategies: Modular design, customized packages.

5. Franchise Model: Expanding the Brand

How It Works:

In the franchise model, a flex workspace brand licenses its brand, operational model, and support systems to independent franchisees. This allows the brand to expand its footprint without investing heavily in new locations, while franchisees benefit from brand recognition and established processes.

Target Clients:

Corporations, small businesses, freelancers, and independent franchisees who are interested in operating a flex workspace under an established brand.

Revenue Streams:

Revenue comes from membership fees, additional services, and a percentage of profits shared with the franchise brand. Franchisees also pay an initial franchise fee and ongoing royalties to the brand.

Benefits and Challenges:

The franchise model enables rapid expansion with lower capital investment, spreading the brand across new regions while sharing operational costs. However, maintaining brand consistency and quality control can be challenging, especially when franchisees operate independently. Franchisees also face the risk of market saturation and high competition.

Occupancy Considerations:

Ideal Rate: 75-85%.

Strategies: Training, localized marketing.

6. On-Demand and Virtual Office Model: Catering to Remote Needs

How It Works:

The on-demand model allows clients to rent workspace or meeting rooms by the hour or day, while virtual offices provide a business address, mail handling, and occasional access to physical space. This model is ideal for clients who don’t need a full-time workspace but want a professional address and access to occasional office amenities.

Target Clients:

Freelancers, remote workers, digital nomads, and companies looking to establish a business presence without leasing a physical space full-time.

Revenue Streams:

Revenue in this model is generated through hourly or daily booking fees, virtual office memberships, and additional fees for mail handling, call forwarding, and access to meeting rooms.

Benefits and Challenges:

The on-demand model has a low barrier to entry and appeals to a wide client base. However, revenue can be unpredictable due to its dependence on daily demand. Virtual offices also face increased competition from digital alternatives, making it essential for operators to offer attractive, unique features.

Occupancy Considerations:

Ideal Rate: High peak-time (50-60%).

Strategies: Peak pricing, digital marketing.

7. Corporate Membership Model: Scaling for Enterprise Clients

How It Works:

The corporate membership model is designed for large organizations that want to provide their employees with flexible workspace options across multiple locations. Instead of renting a specific space, companies pay for memberships that allow their employees to access various locations on a global or regional basis.

Target Clients:

Large enterprises and corporations that operate globally or regionally and want to give employees flexible access to workspaces.

Revenue Streams:

Revenue comes from corporate membership fees, which are structured based on usage and volume. Operators may also offer premium memberships that include access to exclusive amenities, meeting spaces, and networking events.

Benefits and Challenges:

The corporate membership model provides recurring revenue from enterprise clients and aligns with the growing demand for hybrid work solutions. However, operators need a strong network of locations and robust infrastructure to accommodate large-scale clients. Additionally, client retention is essential, as losing a major corporate account can impact revenue significantly.

Occupancy Considerations:

Ideal Rate: 80-90%.

Strategies: Flexible access, data analytics.

How the REIT Model Works for Flex Workspaces

REITs are investment vehicles that allow individuals to invest in large-scale, income-generating real estate properties, receiving dividends from the income generated by these assets. The REIT model for flex workspaces generally involves REITs acquiring, owning, and leasing buildings that are operated as flexible workspaces. These spaces are then managed either by the REIT itself or in partnership with established flex workspace operators.

"REITs could help unlock liquidity and allow for a more structured and efficient capital inflow into the sector, which could support its long-term growth. This would provide flexible workspace companies with more opportunities for expansion and innovation by tapping into larger pools of capital" — Sumit Lakhani, Deputy CEO of Awfis

Two Main Approaches for Flex Workspace REITs:

Direct Ownership and Management: The REIT directly owns and operates the flexible workspace, often setting up a dedicated operational team to manage it. This approach requires the REIT to invest in branding, marketing, and daily management, similar to a typical flex workspace operator.

Partnerships with Operators: Some REITs form partnerships with established flex workspace operators (e.g., WeWork, IWG, Spaces). The REIT owns the physical assets, while the operator manages the workspace, shares revenue, or pays a rental fee to the REIT based on occupancy and revenue performance.

Benefits of the REIT Model for Flex Workspaces

Incorporating flex workspaces into a REIT structure provides several benefits:

a. Accessibility to Investors

Flex workspace REITs allow retail investors to participate in the growth of the flexible workspace sector without directly investing in or managing a property. This approach provides investors with exposure to the sector’s growth, offering a unique asset class in their portfolios.

b. Stable Income Streams

REITs can leverage the popularity of flex workspaces and high demand in urban centers to generate stable rental income. As corporate clients and enterprises increasingly adopt flexible workspaces, REITs can benefit from recurring revenue driven by long-term leases or revenue-sharing arrangements with workspace operators.

c. Portfolio Diversification

For REITs, adding flex workspaces to a real estate portfolio provides diversification within the commercial property sector. Flex workspaces add a different risk-return profile, as they cater to various tenant types, from freelancers to large corporations, making the portfolio more resilient to demand shifts.

d. Flexibility in Lease Terms

Flex workspaces offer REITs the advantage of shorter leases compared to traditional office properties. This allows REITs to respond more dynamically to market demand and adjust pricing based on occupancy rates and market trends, optimizing revenue.

e. Potential for High Returns in Prime Locations

Flex workspaces in high-demand areas (e.g., New York, London, Mumbai) command premium rents due to their prime locations. REITs that invest in properties in these locations can potentially generate high returns, as the flex workspace model allows for a diversified and often higher-yielding income stream.

Opportunities and the Future of Flex Workspace REITs

Despite the challenges, the flex workspace REIT model has significant growth potential:

a. Corporate Demand for Hybrid Models

As companies shift toward hybrid work models, demand for flexible, on-demand workspaces is expected to rise. Flex workspace REITs can capture this demand by providing a range of space options tailored to corporate needs. This shift toward flexibility may increase corporate commitments to flex spaces, providing REITs with a steadier income stream from enterprise clients.

b. Expansion in Emerging Markets

Emerging markets like India, Southeast Asia, and Latin America present growth opportunities for flex workspace REITs, as demand for flexible office spaces grows in urban hubs. REITs that invest in these high-growth markets can capitalize on rising demand from startups, freelancers, and multinational corporations.

c. Tech Integration and Efficiency

Adopting technology to optimize space utilization, manage occupancy, and offer seamless experiences can make REIT-owned flex spaces more competitive. Technology-enabled flex spaces, integrated with IoT for real-time monitoring, booking systems, and tenant engagement apps, can reduce vacancy rates and streamline operations.

d. Value-Added Partnerships

Some REITs may find it beneficial to partner with multiple operators or hospitality brands to diversify tenant services. Partnerships can offer a unique experience to clients, combining flex spaces with amenities such as wellness services, networking events, and exclusive perks. This approach can attract higher-value tenants and increase tenant loyalty.

Examples of Flex Workspace REITs and Trends

WeWork Partnerships with REITs: WeWork has formed partnerships with various REITs and landlords, transforming traditional office buildings into flexible workspace hubs. These partnerships allow REITs to benefit from WeWork’s operational expertise and established brand while maximizing property revenue.

IWG’s Partnership Model: IWG, which owns Regus and Spaces, has adopted a hybrid approach, working with REITs and property owners to offer flexible office space under revenue-sharing agreements. IWG’s partnership with REITs allows them to expand without direct ownership of properties, aligning interests and reducing capital requirements.

Local and Regional Flex REITs: In markets like India, REITs such as Embassy REIT are exploring partnerships with flex space operators to cater to the country’s startup ecosystem and growing demand for flexible offices. As interest grows, more REITs may enter this space, especially in regions with high growth potential.

Unit economics — Flex Workspace vs Traditional Leasing

Flexible workspaces offer numerous advantages over traditional spaces for tenants, including significant cost savings, as companies pay only for the space they use, potentially reducing overhead expenses by 20%-22% over three years for 100 seats. They provide greater flexibility in lease duration and area requirements, allowing businesses to adapt to changing needs. Tenants benefit from diverse environments that foster creativity and productivity, along with enhanced collaboration opportunities through shared workspaces. From the perspective of space owners, partnering with flexible workspace operators is advantageous as it allows them to provide customized solutions and attract tenants preferring the same operator across multiple locations. Co-working spaces also serve as valuable amenities, catering to various tenant requirements and aiding in tenant retention by accommodating smaller space needs, thus indirectly supporting multiple tenants and enhancing the overall building value. These factors highlight the strategic benefits for both tenants and space owners in the flex workspace industry. The unit economics as follows,

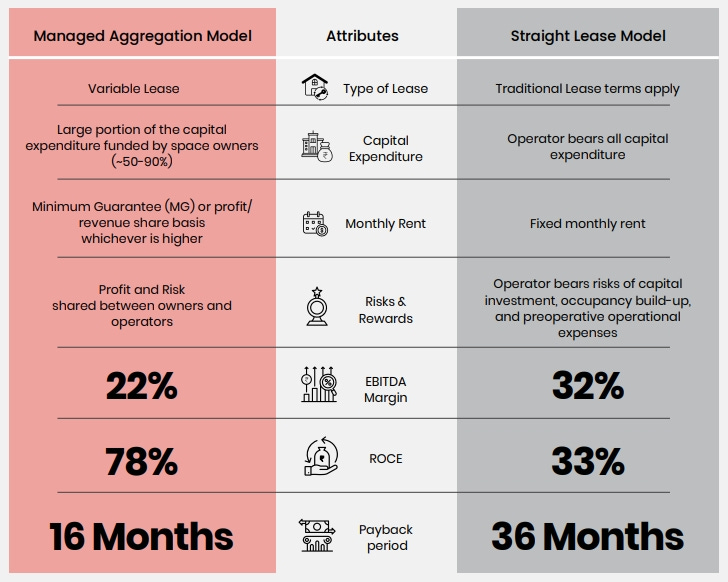

Straight Lease (SL) vs. Managed Aggregation (MA) Model

SL Model: Suited for operators with strong financial resources and market confidence, particularly in high-demand locations where stable occupancy is likely. The potential for higher profits makes this model attractive, but only if occupancy rates can consistently support it.

MA Model: Ideal for operators looking to expand with lower capital and risk, especially in emerging or uncertain markets. By sharing risk with the landlord, the operator can adapt to market changes and still achieve sustainable profitability.

The Straight Lease and Managed Aggregation models represent two ends of the spectrum in operational strategies for flex workspaces. The SL model offers high potential profits and complete control but requires financial resilience and confidence in high occupancy. The MA model, on the other hand, distributes risk between the landlord and operator, making it ideal for markets where demand is uncertain or volatile. E.g. Awfis uses the MA model for its rapid expansion and uses SL model where the demand and supply is already available which makes working on negative working capital hence minimizes the risk for the operator.

Major issue — Asset-Liability Mismatch: A Double-Edged Sword

What is Asset-Liability Mismatch?

An asset-liability mismatch occurs when the assets (properties or leased spaces) held by a company do not align with its financial liabilities (lease payments, operational costs) in terms of timing or flexibility. In the flex workspace sector, this mismatch is particularly prominent when operators commit to long-term leases with fixed payments while generating revenue from short-term client memberships. This discrepancy can lead to financial strain if occupancy fluctuates or demand declines.

Impact of Asset-Liability Mismatch in Flex Workspaces:

Fixed Long-Term Obligations vs. Variable Short-Term Income: Flex workspace operators often lease properties for multiple years, locking in fixed rent payments. However, their revenue relies on short-term memberships, which are inherently more volatile. If occupancy dips, operators still bear the fixed cost burden, creating a cash flow mismatch.

Cash Flow Challenges During Downturns: In economic downturns or low-demand periods, asset-liability mismatches can lead to significant cash flow issues. Operators are left with fixed liabilities while their revenue drops, increasing the risk of financial instability.

Operational Rigidity: Fixed long-term leases prevent operators from adjusting their real estate commitments based on demand. If an operator overestimates demand and leases too much space, they may face prolonged vacancies that increase liabilities without corresponding revenue.

Strategies to Mitigate Asset-Liability Mismatch:

Flexible Lease Agreements: Operators can negotiate shorter leases or opt for managed agreements that share revenue with landlords, reducing the risk of a mismatch.

Diversified Membership Options: Offering a mix of long-term and short-term memberships can help stabilize revenue and reduce reliance on highly volatile short-term clients.

Financial Hedging and Reserves: Building cash reserves or using financial instruments to hedge against occupancy fluctuations can help operators cover liabilities even when revenue dips.

Major issue — Supply-Demand Mismatch: Balancing Market Dynamics

What is Supply-Demand Mismatch?

Supply-demand mismatch occurs when the available flex workspace inventory in a market does not align with the actual demand. This can manifest as oversupply, where too many spaces are available compared to demand, or undersupply, where demand exceeds available space. Both situations create operational and financial challenges for flex workspace operators.

Impact of Supply-Demand Mismatch in Flex Workspaces:

Oversupply Risks: When too many operators enter a market, they compete heavily for the same pool of clients, leading to lower occupancy rates, decreased pricing power, and margin compression. Oversupply is particularly evident in major cities where multiple operators lease prime spaces, often in close proximity to one another.

Pricing Pressure: In an oversupplied market, operators may feel pressured to lower prices to attract clients. This can reduce profit margins and make it challenging to cover fixed costs, particularly in asset-heavy models like Straight Lease.

Difficulty in Retention: In markets with high supply, clients have numerous options, making it difficult for operators to retain members. They must differentiate themselves with amenities, community-building efforts, or price incentives, all of which require additional resources.

Undersupply Risks: In markets with limited flex space availability, operators may miss revenue opportunities by not meeting demand. This can lead to customer dissatisfaction or missed potential for revenue growth.

Strategies to Mitigate Supply-Demand Mismatch:

Market Research and Demand Forecasting: Rigorous market research can help operators identify demand trends and avoid over-expansion into areas where demand may be uncertain.

Dynamic Pricing Models: Implementing dynamic pricing allows operators to adjust rates based on demand fluctuations, capturing higher revenue in peak periods while remaining competitive during lower-demand times.

Scalable Space Models: Offering flexible configurations, such as movable walls and modular layouts, allows operators to adjust the type and amount of space available based on demand. Choosing MA model to share the risk.

Case Study — WeWork a cautionary tale of over-expansion and financial strain

WeWork, one of the most recognizable names in the flex workspace sector, provides a valuable case study in asset-liability mismatch and supply-demand dynamics. Founded in 2010, WeWork quickly expanded to become a global leader in flexible workspaces, operating in hundreds of locations worldwide. However, its rapid growth and financial structure exposed weaknesses that ultimately led to a significant restructuring.

WeWork’s Expansion and Business Model

WeWork’s business model focused on leasing prime real estate locations on long-term leases, renovating and designing these spaces to create branded, community-oriented work environments, and then subleasing the space to short-term clients. The model relied heavily on maintaining high occupancy rates and charging a premium for the WeWork brand and community experience.

Challenges WeWork Faced with Asset-Liability Mismatch

Long-Term Lease Commitments: WeWork signed long-term leases, often lasting 10-15 years, across multiple cities worldwide. This created fixed liabilities that remained constant regardless of occupancy.

Short-Term Revenue: WeWork’s client agreements were typically month-to-month or short-term, making its revenue highly volatile. When occupancy dipped, the company was left with the full burden of its fixed lease obligations.

High Burn Rate: WeWork’s high capital expenditure on renovations, amenities, and marketing contributed to its significant cash burn. This further exacerbated the asset-liability mismatch, as the company needed high occupancy to cover its mounting fixed costs.

Supply-Demand Mismatch: Expansion Ahead of Demand

WeWork aggressively expanded into new cities, often outpacing actual demand. This resulted in oversupply in several markets, where WeWork locations competed not only with other operators but with additional WeWork locations nearby.

Pricing Pressure: In oversaturated markets, WeWork struggled to maintain its premium pricing, which led to price cuts and discounts to attract clients. This further strained its ability to cover fixed costs.

Difficulty Retaining Clients: WeWork’s rapid expansion diluted its brand’s exclusivity, and clients had ample alternatives in the form of competing operators or even other WeWork locations. The lack of differentiation in certain oversupplied markets made retention difficult.

Financial Consequences and Restructuring

In 2019, WeWork’s attempt to go public revealed substantial financial losses, and investor confidence dropped sharply. As the company’s financial statements became public, the market saw that WeWork’s growth had been fueled by heavy borrowing and leases that it could not sustainably support without high occupancy rates. The asset-liability mismatch and oversupply in key markets led to a crisis of confidence.

Cost-Cutting and Downsizing: WeWork restructured, exiting leases in underperforming markets and reducing its footprint in oversupplied cities. It pivoted toward a Managed Aggregation model, where it formed revenue-sharing agreements with landlords to reduce fixed liabilities.

Increased Focus on Corporate Clients: WeWork began targeting larger enterprise clients, who typically sign longer-term agreements, providing a more stable income stream compared to freelancers or startups.

Lessons from WeWork: Learn from history

The WeWork case underscores the importance of aligning operational models, financial structures, and market strategies with realistic demand and occupancy forecasts. Here are some key takeaways for flex workspace operators:

Match Liabilities to Revenue Models: Operators should avoid heavy reliance on long-term leases if their revenue is based on short-term memberships. Instead, models like Managed Aggregation or hybrid approaches may be more suitable for balancing risk and reward.

Focus on Sustainable Growth: Expanding too quickly without adequate demand forecasting can lead to oversupply, price pressure, and reduced brand equity. Operators should prioritize sustainable growth, ensuring demand justifies expansion in each new location.

Diversify Client Base: By targeting a mix of corporate clients and individuals, operators can stabilize occupancy and revenue. Long-term corporate clients provide a steady income stream, reducing reliance on short-term, more volatile clients.

Financial Resilience: Operators should build cash reserves and contingency plans to manage periods of low occupancy. WeWork’s high burn rate and dependence on external funding contributed to its challenges, underscoring the importance of managing capital efficiently.

Competitive Advantages — How to build Moats in Flex Workspaces

Key Competitive Advantages in the Flex Workspace Industry:

Prime Location and Accessibility: Being in high-demand urban centers or near transport hubs offers a significant competitive advantage. Clients prefer workspaces that minimize commuting time and provide easy access to key business areas.

High Switching Costs: Increase client retention by creating a degree of “stickiness” that discourages clients from moving to competitors. Flex workspace operators often capitalize on this by offering premium services, custom setups, and community engagement initiatives to deepen client loyalty.

Technology Integration: Advanced technology such as seamless booking systems, IoT-enabled spaces, and virtual collaboration tools enhance the user experience and streamline operations, giving tech-savvy operators an edge.

Community and Networking Opportunities: Many clients choose flex workspaces for the collaborative environment and networking events. Spaces that foster a sense of community and offer professional development events can attract and retain clients.

Operational Efficiency and Cost Management: Operators with efficient cost structures (e.g., via revenue-sharing models or scalable layouts) can offer competitive pricing without compromising profitability, appealing to both startups and large companies.

High Initial Capital Requirements: Setting up a flex workspace involves significant capital expenditure for property Fit-outs, furnishings, technology, and branding. Without substantial financial resources, new entrants find it difficult to compete.

Prime Real Estate Scarcity: Securing prime real estate in central business districts is challenging and costly, especially in oversaturated markets. Established operators with existing leases in desirable locations have a significant advantage.

Brand Loyalty and Client Relationships: Established brands with strong reputations enjoy high client loyalty, particularly among corporate clients. New players must invest heavily in marketing and relationship-building to attract clients.

Economies of Scale: Larger operators benefit from economies of scale, reducing costs on furniture, technology, and services. These cost advantages allow established players to offer competitive pricing that may be challenging for new entrants to match.

Relocation Costs: Moving from one workspace to another involves logistical expenses, particularly for larger teams or enterprises with dedicated setups. The hassle of relocation can deter clients from switching.

Branding and Customization: Corporate clients who have invested in customizing their space (e.g., branded decor, private suites) incur high switching costs if they need to recreate this setup elsewhere.

Contractual Commitments: Some flex workspaces offer discounts for longer-term commitments, which can serve as a barrier to switching, as clients may lose financial benefits if they leave before the contract ends.

P2P Analysis among Indian flex workspace industry

Analyst PoV — Key metrics to track

Occupancy Rate: Measures the percentage of rentable space that is currently occupied. A high occupancy rate (closer to 85%) indicates strong demand and efficient use of space. Below 70% may suggest market saturation or ineffective client acquisition. A healthy occupancy rate typically falls between 75-85%. (Occupancy depends on the model that a company uses hence this number can not seen in hindsight).

Breakeven Occupancy Rate: The minimum occupancy required to cover fixed costs. Breakeven below 70% indicates strong cost management. Operators with high fixed costs may struggle to meet breakeven in volatile markets.

RevPASF (Revenue per Available Square Foot): Calculates revenue generated per square foot of space, providing insight into how effectively the space is monetized. Higher RevPASF indicates effective monetization of space, typically achieved in metro areas like Mumbai, Bengaluru, Pune and Delhi NCR. This is typically ₹6,000 - ₹8,500 per square foot.

Space Utilization Rate: Compares actual usage of the workspace to its maximum capacity. This metric is critical for understanding peak vs. off-peak usage and overall space efficiency (carpet size). Companies add a lot of amenities in larger place to attract more customers, but this is inefficient way of space utilization.

Desk Occupancy Rate: Specific to hot desks or dedicated desks, it shows how often these desks are utilized. High desk occupancy rates can indicate strong demand and efficient space use. This usually falls between 70-80%.

Churn Rate: Measures the rate at which clients leave the workspace. A high churn rate indicates issues with client retention, while a low churn rate suggests strong client loyalty and satisfaction, especially critical in the Indian market where clients tend to be price-sensitive. This can range from 15-20% annually.

EBITDA Margin: Measures profitability as a percentage of revenue, showing how efficiently the company operates and manages its costs. Operators with margins above 20% typically have strong cost control or premium pricing models.

Average Revenue per User (ARPU): Calculates the average revenue generated per client. It can highlight whether the company is attracting higher-value clients or relying on high volumes of lower-value clients. This can range from ₹12,000 - ₹35,000 per month. High ARPU (₹30,000+) suggests a premium client base or corporate memberships. ARPU at the lower end often reflects individual clients or startups. One must also see the how ARPU is segmented by client type (e.g., corporate, startup, freelancer) to understand where high-value clients are concentrated.

Capex-to-Revenue Ratio: Reflects the capital intensity of the business by showing how much Capex is required to generate revenue. : This ratio reflects capital intensity. A ratio above 25% may indicate heavy investment in property setup, while ratios below 20% suggest more efficient use of capital. This depends on operational model of the business hence shouldn’t be seen in hindsight.

Fixed vs. Variable Costs: Helps analyze the cost structure. High fixed costs (e.g., leases) can create financial strain during low occupancy periods, while flexible lease agreements can reduce this burden. This creates situations like asset liability mismatch. Business has to suffer or might even have to shut down its operations in a black swan event

Debt-to-Equity Ratio: Shows the proportion of debt in the company’s capital structure. A high ratio indicates reliance on debt, which may increase financial risk, especially if occupancy rates fluctuate. On must track this metric as high debt leads to high interest expenses and this is a fixed cost.

Client Composition: Breakdown of revenue by client type (e.g., freelancers, startups, corporate clients). A diversified client base can indicate risk mitigation, as reliance on any single client type increases vulnerability.

Client Tenure: Measures the average duration clients remain with the workspace. Longer client tenure, especially among corporate clients, indicates strong retention and revenue stability. 10-14 months for individual clients; 2+ years for corporates. Churn is very high in individuals (e.g. Freelancers).

Recurring Revenue Rate: Indicates the percentage of revenue from long-term contracts versus short-term memberships. Higher recurring revenue suggests stability and predictability. Anything above 65% over long period is considered good.

Corporate Client Ratio: Measures the percentage of revenue from corporate clients. A higher ratio often indicates revenue stability, as corporate clients usually commit to longer-term agreements. Corporate clients make up 50-60% of total revenue.

Market Share: The company’s share in the regional or global flex workspace market. A strong market share indicates a competitive edge and potentially higher brand recognition. Top 3-5 players control over 50% of the market in key metro cities.

Location Mix: Distribution of locations across prime, secondary, and suburban markets. A presence in prime locations can attract higher-paying clients but comes with higher lease costs. Hence one should know the micro market environment.

Brand Equity and Client Satisfaction: Analyzing client reviews, net promoter scores (NPS), or customer satisfaction surveys can provide insights into the brand’s reputation and client loyalty. Scores above 30 are ideal for long-term retention.

Space Turnover Rate: Measures how frequently workspace areas are reconfigured or redeployed to meet demand. A high turnover rate can indicate responsiveness to client needs but may also reflect operational instability. Moderate turnover in space configurations (2-3 times a year) allows operators to adapt spaces to demand trends without heavy operational disruptions.

Capex Efficiency: Compares capital expenditures to revenue generated, showing how effectively Capex spending translates into revenue. Capex per seat under ₹100,000 is efficient, reflecting optimal investment in high-demand locations. Higher costs are justified if locations are high revenue. This also varies among operation bunnies models.

Lease Expiration and Renewal Rate: Tracks upcoming lease expirations and the rate at which leases are renewed. This is especially important for operators with high fixed-cost obligations. High lease renewal rates in prime locations indicate viability and good landlord relationships, critical in India’s competitive real estate markets. 70-80% renewal rate for prime locations considered good.

Revenue per Employee: This metric reflects labor productivity by measuring the revenue generated per employee. High revenue per employee (above ₹1.75 crore) indicates efficient use of human resources. Lower productivity may suggest overstaffing or underperforming locations.

Asset-Liability Mismatch: Examines the balance between long-term lease obligations and short-term client revenue. High mismatch indicates financial strain during periods of low occupancy. We have studied this above in detail with the case study of WeWork.

Location Concentration Risk: Measures the concentration of locations in a particular market or city. High concentration in a single market (e.g., Mumbai) exposes the company to regional economic risks. Revenue diversification across multiple cities mitigates concentration risk.

Checklist — A structured approach to the analysis

"Investing is a matter where you should look at the downside before you look at the upside. Use a checklist to make sure you’re not forgetting anything. It’s like a pre-flight checklist for an airplane. It may seem simple, but it’s extremely powerful" — Warren Buffett

“Under conditions of complexity, not only are checklists a help, they are required for success. There is no other choice.” — Atul Gawande

What is the business/operational model (e.g. straight lease, managed aggregation, hybrid etc)?

What is the projected market growth rate in key target regions?

Is the market still expanding, or are certain areas approaching saturation?

Are locations chosen based on business density and proximity to high-value clients?

Does the operator balance high-rent, prime locations with secondary markets to reduce cost risks?

Is the operator well-positioned in high-demand locations?

How does the operator rank among top competitors in each key market?

Are there specific competitive advantages (e.g., strong brand, exclusive amenities) that set the operator apart?

What unique elements or services attract clients, especially in competitive urban centers?

Does the operator’s brand emphasize community, technology, or premium spaces, and how is this communicated?

What is the operator’s average occupancy rate compared to industry benchmarks?

Are peak and off-peak occupancy rates managed effectively to optimize revenue?

How effectively does the operator manage its rent and operational costs?

How does the operator’s revenue per square foot compare to competitors in similar markets?

Are there opportunities to increase RevPASF through additional services or better space utilization?

How does the rent-to-revenue ratio compare to industry benchmarks, and does it vary across locations?

What measures are in place to control rent, utilities, and maintenance expenses?

Is the operator using technology to streamline operations, track occupancy, and reduce costs?

What % of Revenue comes from IPCs/Brokers?

What is sector wise Revenue mix (e.g. IT, BFSI etc.)?

Does the operator leverage tech-enabled solutions (e.g., booking apps, IoT) that enhance client experience?

What percentage of revenue comes from diversified sources (e.g., events, meeting rooms, corporate packages)?

Does the operator rely heavily on one client type, and is revenue diversification prioritized?

How does the EBITDA margin compare to industry averages, and what factors drive or hinder profitability?

Are there specific locations or client segments contributing disproportionately to profit margins?

What is the payback period on recent Capex investments, and is it within the operator’s target range?

Are there opportunities to optimize Capex, such as modular designs or revenue-sharing agreements?

Is free cash flow positive, and can it support growth without additional debt?

How much of FCF is used for expansion vs. debt repayment, and is it managed sustainably?

What percentage of clients are large corporates, and how does this impact revenue stability?

Is the client mix diverse enough to reduce dependency on high-churn segments like freelancers?

What is the churn rate by client segment (e.g., freelancers vs. corporates), and how does it compare to competitors?

What strategies are in place to reduce churn, especially in segments with high turnover?

How does Customer Lifetime Value (CLV) compare across client types, and are there efforts to increase it through loyalty programs or premium services?

Is the operator tracking CLV and making adjustments to improve retention and reduce acquisition costs?

Does the operator facilitate networking and community-building events that enhance the client experience?

Are there network effects that make the space more valuable as membership grows, such as access to a larger client base?

Are lease terms aligned with client tenure, or are there mismatches that could increase financial risk?

What percentage of leases are flexible or revenue-sharing, and how does this help balance costs with occupancy?

How exposed is the operator to economic downturns, and what plans are in place to mitigate this?

Are cash reserves or contingency plans sufficient to cover low-occupancy periods?

What is the operator’s breakeven occupancy rate, and is it achievable based on recent occupancy trends?

How does breakeven vary across locations, and are higher-cost locations at greater risk?

Can the operator exit leases early or downsize in response to market changes?

How often does the operator review underperforming locations, and what are the criteria for closing them?

How do EV/Revenue and EV/EBITDA multiples compare to similar operators in the region?

Is the operator’s valuation driven by unique advantages (e.g., high client retention, premium locations) that justify a higher multiple?

How quickly can the operator pivot to remote or hybrid-friendly services if client needs shift?

Are new service offerings, such as virtual offices or hybrid work solutions, part of the growth strategy?

Is the operator collecting and leveraging client data to improve space usage, pricing, or retention?

Are analytics tools in place to monitor client preferences, peak usage times, and service performance?

"Checklists seem able to defend anyone, even the experienced, against failure in many more tasks than we realized. They provide a kind of cognitive net. They catch mental flaws inherent in all of us—flaws of memory and attention and thoroughness." — Atul Gawande

These set of questions gives a detailed roadmap for analyzing the flex workspace industry. Each question provides a lens for understanding the unique factors that drive performance, stability, and valuation, allowing analysts or investors to evaluate operators from every angle. This thorough approach ensures well-rounded insights into an operator's market positioning, financial resilience, client dynamics, risk exposure, and overall growth potential.

Here it concludes

Here it comes finally, we are in the final stage of this analysis of Flex-space so let’s conclude. In this article, we have gone through complex and rapidly evolving landscape of the flex workspace sector, providing a structured framework that investors and analysts alike can use to assess performance and growth potential. From understanding the key drivers of market potential and competitive positioning to evaluating operational efficiency and financial health, each metric and benchmark serves as a critical piece in analyzing a flex workspace operator's long-term success.

We delved into client dynamics, highlighting the importance of managing churn, increasing retention through community-building, and securing a stable client mix. These elements are essential to creating sustainable revenue streams in an industry where low switching costs make client loyalty challenging to achieve. Additionally, we saw the need for flexible lease agreements, diversified revenue sources, and effective cost management to safeguard operators against economic fluctuations.

Finally, the benchmarks offer valuable insights for understanding how flex workspace operators can position themselves competitively in this market. By focusing on metrics like occupancy, rent-to-revenue ratios, and capex efficiency, operators and investors alike can gauge whether an operator is poised for success or faces potential pitfalls.

Thank you for following along with this deep dive! As the flex workspace industry continues to grow and adapt to changing work patterns, a comprehensive, data-driven approach remains key to making informed investment decisions and building resilient business strategies. In our upcoming blogs we will deep dive into a leading player AWFIS Space Solutions Ltd (Incorporated in December 2014, Awfis is a workspace solution provider in India).

References:-

AWFIS — RHP & Annual Report (FY24)

AWFIS Concalls - Q4 FY24 & Q1FY25

CBRE Report on Indian office Q3 2024

CBRE - “Industry Report on Flexible workspace segment in India”

Avendus - “Flex workspace, a USD 9Bn market opportunity by 2028”

JLL - India’s Flex Space Market Analysis FY23

Pwc Survey - Workspaces of the future

PPFAS - “Factors driving co-working spaces”

Smart sync services — “Co-working office spaces”

Substack: Abhay’s Substack | Abhay Sahukar | Substack

Twitter: (1) Abhay Sahukar (@AbhaySahukar7) / X

Stay tuned!

See you next time!

Simply WOW. Such an exhaustive work. Great going Abhay. Keep it up. Just didn't find any details about the EFC company which is listed. Can you PLEASE share your insights on EFC(I) in short?

Thanks in advance.

Excellent work. The best work I have read on flex spaces.