Understanding ROCE: A Comprehensive Guide to Capital Efficiency, Risks, and Strategic Insights

Return on Capital Employed (ROCE) is a vital metric that helps investors assess how efficiently a company uses its capital to generate profits. More than just a number, ROCE provides a deeper understanding of the company's operational strength, capital structure, and profitability. However, ROCE can sometimes be misleading and must be interpreted with care. In this article, we’ll explore ROCE in depth, calculate it using examples, examine how it can be manipulated, just as with Return on Equity (ROE), ROCE can also be broken down using the Dupont Method, which offers deeper insights into the drivers of profitability. This breakdown helps investors Analyse a company's performance more thoroughly. We also going to discuss its significance in light of strategic capital allocation, drawing insights from investment philosophies such as Terry Smith’s Investing for Growth. let’s begin

What is ROCE?

ROCE measures the profitability and efficiency of a company’s capital investments. It's a useful indicator of long-term financial health, as it shows how much profit a company generates for each unit of capital employed in its business. This is especially useful for investors looking to compare companies within the same industry. A higher ROCE indicates that the company is using its capital more efficiently to generate returns.

Where:

EBIT is the operating profit of the company before interest and taxes.

Capital Employed total capital invested in a business it can be calculated as:

Capital Employed = Total Assets−Current Liabilities−cash

Or alternatively:

Capital Employed = Equity+Debt−cash

This formula gives a ratio that illustrates how efficiently a business is using its capital to generate profits. in the calculation of capital employed we are subtracting cash because itis just lying in the balance sheet and not generating any returns .

Step-by-Step Calculation of ROCE Using an Annual Report

Let’s break down the process of calculating ROCE using a real-world example—Yatharth Hospital 2024 annual report.

Step 1: Locate EBIT

Look for EBIT in the Income Statement or P&L statement of the annual report. If not directly listed, you can calculate EBIT by subtracting operating expenses from revenue or using net income and adding back interest and tax or using profit before tax just add back interest expense and here you again can land on to the EBIT. There are many ways to the calculation and hope you got the point.

In case of Yatharth hospital PBT is of 156.83cr to this add back interest expense i.e. 9.41cr from this we get to EBIT of Rs.166.25cr

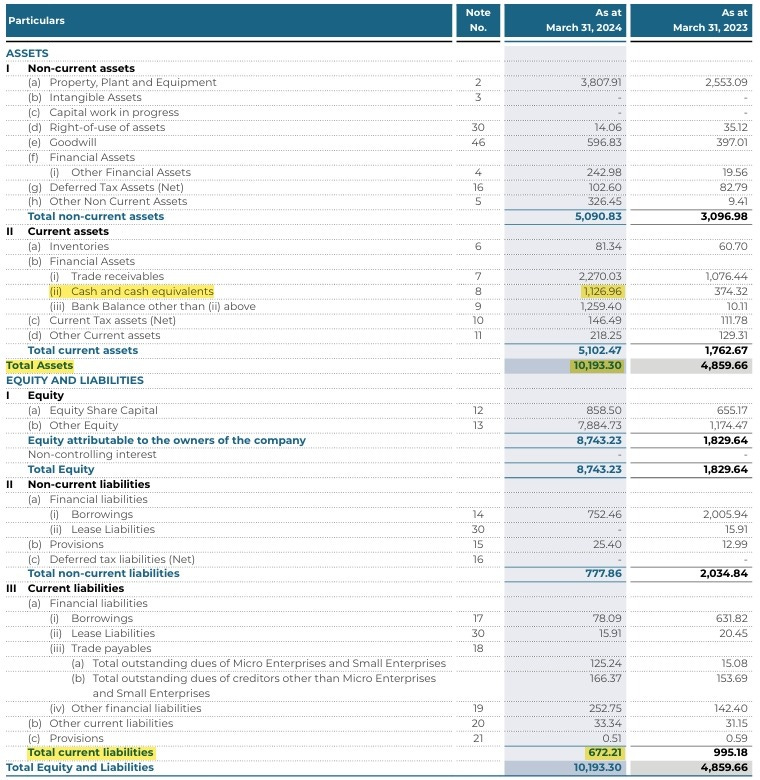

Step 2: Calculate Capital Employed

Capital Employed can be calculated in two ways as mentioned above, both works well for now we are using Total Assets−Current Liabilities−cash (all these will be located in balance sheet)

Total Assets = ₹1,019.33cr

Current Liabilities = ₹67.22cr

Cash = ₹113cr

Which gives us our Capital Employed = ₹974cr

Step 3: Final dish to taste

Once you have both the ingredients for the dish i.e. EBIT and Capital Employed, now its walk on the cake just have to divide EBIT by Capital Employed and express the result as a percentage.

ROCE = 166.25/974×100 which gives us 17.06%

Note : In our calculation we have subtracted the cash because this is just lying in the balance sheet not actually generating any returns hence if we hadn’t subtracted it than we might not have got the core RoCE (if we add it we get higher RoCE which might be misleading in our view).

Understanding the factors that influences ROCE

ROCE can provide excellent insight into a company’s capital efficiency, but it’s crucial to consider its nuances. Several factors can affect this metric, and they should be analyzed to avoid drawing false conclusions.

Sector-Specific Benchmarks: ROCE can vary significantly between industries. Capital-intensive industries like steel, airlines, or utilities tend to have lower ROCEs due to the high capital base required. In contrast, tech and services industries, which require less fixed capital, typically have higher ROCEs. Comparing ROCE across industries without context may lead to inaccurate assessments.

Depreciation Effects: Since ROCE uses EBIT, the way a company manages depreciation can affect the results especially in industries with high levels of fixed assets like real estate and manufacturing. Companies with aggressive depreciation policies will show lower EBIT, leading to reduced ROCE. However, this may not reflect their true operating efficiency. A company with newer assets may have a lower EBIT due to higher depreciation costs, which can lower ROCE even if the company’s operations are efficient. hence one must keep watch on the depreciation cost.

Interpreting Negative ROCE: A negative ROCE can be a red flag for investors, as it suggests that the company is destroying value—it’s investing in capital but failing to generate a return. This can occur in heavily indebted companies or those suffering from declining margins. However in some cases, a negative ROCE may not always indicate a poorly performing business, particularly when a company is entering new segments, expanding into new geographies, or incurring high R&D expenses. These factors can temporarily suppress returns, making the business appear less competent. However, it’s crucial to look beyond the numbers. Qualitative factors like the management's expertise, execution track record, corporate governance, etc can offer valuable insights. A strong management team with a history of good execution can turn initial setbacks into long-term value creation. As investors, it's essential to develop a balanced view that combines both quantitative and qualitative analysis to make informed decisions. In these situations, patience and a deep understanding of the business and it’s nature helps to build conviction.

Adjustments for Non-Recurring Items: Companies may have one-time events such as asset sales, lawsuits, or restructuring costs, which can inflate or reduce EBIT (Earnings Before Interest and Taxes). If these non-recurring items are not adjusted for, ROCE might present an overly optimistic or pessimistic view of the company's true profitability. For example, a company might report an unusually high EBIT in a year due to selling off a subsidiary. This temporary boost can lead to an inflated ROCE, which does not reflect the company’s ongoing operating efficiency.

Capital Structure: ROCE doesn’t take into account how the capital is financed (whether through debt or equity). Two companies might have similar ROCE values, but one could be much riskier due to higher debt levels. High debt levels lead to financial risk, but this is not visible when looking solely at ROCE.

Fluctuations in Capital Employed: The capital employed (Total Assets – Current Liabilities) might fluctuate due to seasonal changes in working capital (like inventories, receivables, and payables). If ROCE is calculated during a period of low working capital, the metric can show an artificially high return, and vice versa during a period of high working capital. One must also look for the working capital requirement across cycles and can be compared with peers to get better understanding.

Changes in Accounting Policies: Sometimes, companies might change their accounting methods, such as how they report depreciation or inventory, which can impact both EBIT and capital employed. These changes can make historical comparisons of ROCE challenging and potentially misleading if not carefully accounted for.

Share Buybacks: Companies that repurchase their own shares reduce the equity component of their capital employed, thereby boosting ROCE artificially. While this can be beneficial if shares are undervalued, buybacks done at overvalued levels can destroy shareholder value in the long term.

Short-Term Improvements vs. Long-Term Sustainability: A company might increase its ROCE in the short term by cutting essential expenditures like R&D or deferring capital investments. However, over time, this can lead to weaker growth, deteriorating competitiveness, and declining operational quality.

Dupont ROCE Breakdown: Unveiling the Drivers

Return on Capital Employed (ROCE) is widely used to evaluate how effectively a company generates profits from its capital. As we explored earlier, ROCE gives an indication of a company’s efficiency in using its capital base, combining debt and equity to produce profits. However, just as with Return on Equity (ROE), ROCE can also be broken down using the Dupont Method, which offers deeper insights into the drivers of profitability. This breakdown helps investors analyse a company's performance more thoroughly.

The Dupont ROCE Formula Breakdown

The Dupont Method, initially developed for ROE, can also be adapted to ROCE. It breaks ROCE into key components that allow for a detailed examination of what influences the metric. This helps identify whether operational efficiency, capital structure, or both are contributing to ROCE growth or decline.

The Dupont formula for ROCE is expressed as follows:

This formula breaks ROCE into two parts:

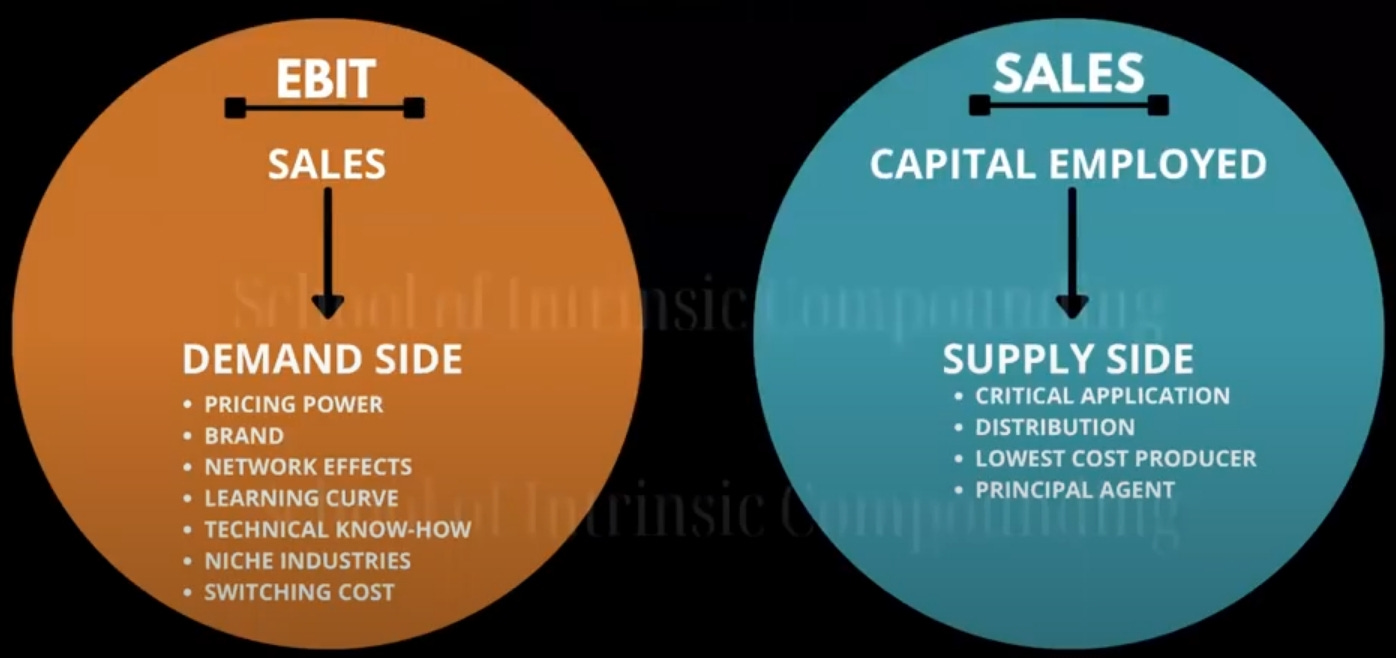

Operating Profit Margin (EBIT/Revenue): This indicates how much operating profit a company generates for every unit of revenue. It’s a measure of operational efficiency, showing how well the company controls its costs relative to its revenue.

Capital Turnover Ratio (Revenue/Capital Employed): This reflects how well the company uses its capital to generate revenue. The higher the turnover, the more efficiently the company is using its capital base to produce sales.

By breaking ROCE into these two components, the Dupont method highlights:

Profitability (how much profit is made from sales)

Efficiency (how effectively capital is used to generate sales)

Dupont Method ROCE Calculation Example

Let’s consider Yatharth hospital again, with the following data:

EBIT: ₹166.25cr

Revenue: ₹670.54cr (can be located in P&L or Income statement)

Capital Employed: ₹974cr

Step 1: Operating Profit Margin

Operating Profit Margin= EBIT/Revenue= 166.25/670.54= 0.247 or 24.7%

This shows that Yatharth hospital earns ₹0.25 in operating profit for every ₹1 of revenue.

Step 2: Capital Turnover Ratio

Capital Turnover Ratio= Revenue/Capital Employed= 670.54/974= 0.69 or 68.8%

This shows that the company generates ₹0.69 in revenue for every ₹1 of capital employed.

Step 3: Dupont ROCE

ROCE= 0.25×0.69= 0.17 or 17.06%

Thus, the company has a ROCE of 17.06%, showing that it earns ₹0.17 in profit for every ₹1 of capital employed. This breakdown shows that the company’s ROCE is driven by strong capital turnover rather than high margins. This analysis helps pinpoint areas where the company excels or might need improvement.

Benefits of Using the Dupont Method for ROCE

Pinpointing Drivers of Performance: The Dupont formula reveals whether an increase or decrease in ROCE is driven by operating efficiency (profit margins) or capital efficiency (turnover). For example, if ROCE is falling, the Dupont breakdown can show if it's due to declining profitability or poor capital utilization.

Comparing Industry Peers: Different industries have different capital structures and operating models. The Dupont method allows you to dissect ROCE in a way that’s more comparable across industries by looking at the separate components (profit margins and capital turnover). For example, capital-intensive industries may have lower turnover but higher margins, while asset-light companies may have lower margins but much higher turnover ratios.

Performance Benchmarking: By analyzing the individual components of ROCE over time, companies and investors can benchmark their performance, setting specific goals to improve either profit margins or capital turnover (or both).

Strategic Decision Making: For management, the Dupont analysis helps identify which aspects of the business need attention. If a company has a low ROCE due to weak capital turnover, it might consider asset-light strategies, or if margins are weak, focus could shift toward cost reduction and improving pricing power.

Assessment of moats: Dupont ROCE framework is not just a tool for analyzing financial efficiency; it can also play a critical role in identifying a company’s economic moat—its long-term competitive advantage that protects it from competitors. A strong moat enables a company to sustain high returns over time, making it attractive to long-term investors. By breaking ROCE down into its components, the Dupont method allows investors to understand why a company is generating superior returns and how its competitive edge manifests across different areas of the business. This deep analysis helps to identify whether a company has a true moat or if its performance is vulnerable to competitive pressures

How Companies Can Improve ROCE

Companies often take strategic steps to improve their ROCE. Below are some common methods:

Divesting Low-Return Assets: By selling off underperforming or non-core assets, a company can reduce capital employed, which, in turn, increases ROCE. However, management should ensure that divestments are part of a long-term strategic vision rather than short-term profit boosts.

Increase EBIT (Profitability)

Improving Operational Efficiency: Companies can work to reduce operating expenses or improve their sales margins, thereby increasing EBIT.

Raising Prices or Reducing Costs: Effective cost management, improved production processes, or increasing product prices without a corresponding increase in costs can help increase EBIT, which raises ROCE.

Increasing Revenue: Expanding into new markets or launching new products can grow the company’s revenue, thus boosting EBIT and ROCE.

2. Reduce Capital Employed

Sell Non-core Assets: A company might sell off assets that aren’t essential to its main business operations, thereby reducing capital employed and increasing ROCE. However, this may not always be sustainable in the long term.

Optimize Working Capital: Reducing inventories or speeding up receivables collections can decrease the working capital needed, lowering the capital employed and raising ROCE. While efficient working capital management is good, excessively cutting it can result in operational difficulties.

Pay Down Debt: Reducing long-term debt reduces capital employed and can improve ROCE. However, paying down debt also reduces liquidity, and the company might miss out on opportunities for growth if it excessively focuses on debt reduction.

3. Asset Utilization and Turnover

Improve Asset Utilization: Companies that can generate more revenue from the same level of fixed assets or capital employed will see an improvement in their ROCE. This could be achieved through better inventory management, higher capacity utilization, or optimizing the use of machinery and other assets.

Delay New Investments: Companies may postpone capital expenditure (CAPEX) projects, thereby lowering capital employed in the short term and increasing ROCE. However, this could harm future growth prospects, making it an unsustainable strategy.

How ROCE Can Be Reduced

There are several factors that can reduce ROCE, either through lower EBIT or an increase in capital employed.

1. Decreasing Profitability (EBIT)

Falling Margins: If a company is forced to lower its prices due to competitive pressures or increase costs due to higher raw material prices, it could experience a decline in EBIT, lowering its ROCE.

Higher Operating Costs: Rising costs of labor, logistics, or materials without a corresponding increase in revenues can negatively impact EBIT, and therefore ROCE.

Poor Operational Efficiency: Inefficiencies in production, supply chain, or sales operations can increase the operating expenses, thereby reducing EBIT and lowering ROCE.

2. Increasing Capital Employed

Heavy Capital Expenditure (CAPEX): Capital-intensive industries often have to make significant investments in infrastructure or machinery. Large CAPEX projects can increase capital employed in the short term and reduce ROCE, especially if the returns from those investments take time to materialize.

Growth through Acquisitions: Acquiring other companies often increases the assets and liabilities on the balance sheet, leading to higher capital employed. If the acquisition doesn’t lead to immediate profitability improvements, ROCE may decline.

Increased Working Capital Requirements: If a company needs to hold more inventory or extend credit terms to customers (leading to higher receivables), its capital employed will increase, thus reducing ROCE.

3. Overexpansion

Overcapacity: Companies may overinvest in plants, equipment, or inventories, which increases capital employed without a corresponding increase in revenue. This leads to lower ROCE as the capital is underutilized.

Unsuccessful Expansion: Entering new markets or launching new products can initially be costly, with investments in new assets and workforce. If the venture doesn’t pay off immediately, ROCE may drop as capital employed increases without an equivalent rise in EBIT.

Capital Allocation and ROCE: Insights from "Investing for Growth" by Terry Smith

In Terry Smith's Investing for Growth, the concept of capital allocation is a recurring theme, deeply linked to a company’s ability to deliver sustained long-term returns. Capital allocation refers to the process by which a company's management decides how to deploy its capital—whether through reinvestment in the business, paying down debt, distributing dividends, or engaging in share buybacks. The way capital is allocated has a significant impact on ROCE.

Smith emphasizes that effective capital allocation is one of the most important responsibilities of a company’s management. His investment philosophy, often referred to as "buying good companies and doing nothing," is based on identifying businesses with superior returns on capital and management teams that make wise capital allocation decisions. Let’s integrate some of Smith's key principles and insights into how they align with ROCE:

Terry Smith's Approach to Capital Allocation

Focus on High-Quality Companies: According to Smith, the best companies are those that generate high returns on capital and can reinvest those returns at similarly high rates. Such companies tend to maintain a consistently high ROCE. Smith’s mantra, "buy good companies, don't overpay, and do nothing", hinges on finding businesses that allocate capital efficiently without squandering it on low-return investments.

Example: Companies like Unilever or Microsoft excel in generating strong returns on invested capital because they reinvest in areas that drive long-term growth while maintaining their competitive advantages.

Reinvesting in Core Business: One of the most effective ways to maintain or increase ROCE is through reinvestment in the core business—particularly in projects or areas where the company has a competitive advantage. Smith argues that businesses with high returns on capital often have opportunities to reinvest their earnings at similarly high rates. However, not all companies can or should continuously reinvest in their existing operations. Smith cautions against companies that reinvest without discipline, as it can dilute overall returns.

Example: Apple, under Tim Cook’s leadership, has focused on capital allocation by reinvesting in product development, improving operational efficiency, and returning capital to shareholders in a balanced way.

Avoiding Low ROCE Acquisitions: Terry Smith is critical of companies that engage in frequent acquisitions, especially if those acquisitions are made at high prices or in industries where the company has little expertise. Acquisitions can dilute ROCE if the acquired company’s returns on capital are lower than the acquirer’s. Smith views disciplined capital allocation as a major determinant of success, and he believes that acquisitions should only be made when they clearly add value.

Example: Companies like Diageo have been successful in making strategic acquisitions (such as the acquisition of Casamigos) that fit within their core competencies, allowing them to maintain a high ROCE. In contrast, poorly timed acquisitions by other firms often lead to value destruction and lower ROCE.

Share Buybacks and ROCE: Smith views share buybacks as an effective use of capital only if the company is buying back shares at a reasonable price. Buybacks can improve ROCE by reducing the amount of capital employed (since equity shrinks), while EBIT remains constant or grows. However, if the company is buying back shares at inflated prices, this can destroy shareholder value and negatively affect long-term returns.

Example: Berkshire Hathaway engages in opportunistic buybacks, repurchasing shares when they are undervalued, which can boost returns on capital by reducing the denominator (capital employed). Smith, like Buffett, warns against companies that repurchase shares at inflated prices, which can temporarily inflate ROCE but undermine long-term shareholder wealth.

Simplicity in Business Models: Smith believes that companies with simple and focused business models tend to generate high ROCE over time. By focusing on businesses that generate consistent returns, rather than those that rely on complex or highly speculative strategies, investors can achieve more predictable and sustainable returns.

Conclusion: ROCE as a Strategic Investment Metric

ROCE is an essential tool for understanding a company’s capital efficiency and profitability. However, its usefulness goes beyond simply identifying companies with high returns. Investors must dig deeper into the components of ROCE, using frameworks like the Dupont method to understand what truly drives capital efficiency—be it operating margin or capital turnover.

Furthermore, ROCE should be viewed alongside strategic considerations, such as capital allocation and the company’s ability to sustain high returns over time. Drawing from investment wisdom such as Terry Smith’s, we see that prudent capital allocation—whether through reinvestment, disciplined acquisitions, or thoughtful share buybacks—plays a critical role in maintaining or improving ROCE.

Ultimately, ROCE should be part of a broader analysis that includes sector context, competitive positioning, and long-term growth strategies. By combining financial rigor with strategic insight, investors can use ROCE to make more informed decisions and build a portfolio of high-quality businesses.

References:-

Annual Reports & Financial Statements of mentioned companies

Book "Investing for Growth" by Terry Smith, Insights into capital allocation and its relationship with ROCE

Book "Incerto" Series by Nassim Nicholas Taleb, for understanding the role of volatility, randomness, and anti-fragility in financial markets

Investopedia: for basic ROCE formula and interpretation.

Harvard Business Review (HBR), Articles on DuPont Analysis and its role in ROCE evaluation.

Morningstar, Research articles on economic moats and ROCE's role in assessing long-term competitive advantages.

Substack: Abhay’s Substack | Abhay Sahukar | Substack

Twitter: (1) Abhay Sahukar (@AbhaySahukar7) / X

Stay tuned!

See you next time!

Too clean bhai... Class. Thanks for this.